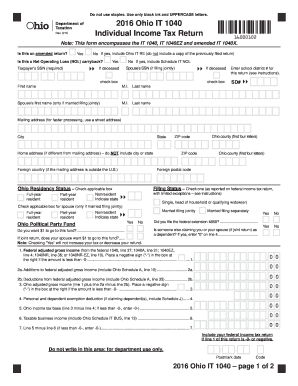

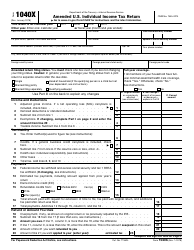

The sooner you file an amended return and pay the tax due, the sooner you’ll stop racking up interest and the failure-to-pay penalty. If you don’t and the IRS discovers the error, the government will bill you for:ġ. The unpaid tax amount plus interest, which is currently at a 4% annual rate, compounded daily, andĢ. The additional failure-to-pay interest charge penalty at a 6% annual rate. If you discover that you understated your tax liability on the original tax return, you’re expected to file an amended return and pay the additional tax. When additional taxes are due. This is a trickier scenario. On the other hand, if you extended your 2016 return to October 16, 2017, and then file before the extended deadline on September 1, 2017, the three-year period for filing an amended 2016 return starts running on September 1, 2017. Based on the three-year rule, you have until April 15, 2020, to file an amended 2016 return and claim your refund. You now realize you should have itemized deductions instead of taking the standard deduction. To illustrate, suppose you filed your 2016 tax return on March 1, 2017, and paid the tax due on that date. However, if you extended the return to October 15 - adjusted for weekends - you’re considered to have filed on the earlier of the actual due date or the October 15 extended deadline. If you filed your original Form 1040 before the April 15 due date - adjusted for weekends and holidays - you’re considered to have filed the return on April 15 for purposes of the three-year rule.

Most taxpayers focus on the three-year rule. If amending your return will produce a tax refund, the deadline for filing Form 1040X is generally the later of:ġ. Three years after the original return for the year in question was filed, orĢ. Two years after the tax for that year was paid. When claiming a refund. The sooner you file an amended return, the sooner you’ll receive any refunds due. How long do you have to file an amended return? The answer depends on whether you’re asking for a refund or you owe additional taxes. That will just create confusion at the IRS and cause headaches for you. The first thing to know is that you should not attempt to correct the situation by filing another original return using Form 1040.

Here are the rules for filing an amended return. Or you might have recently discovered that you failed to claim some legitimate tax breaks on your 2015 return that you filed last year. What should you do if you discover an error on a previously filed individual tax return? For example, you might have missed some tax-saving deductions and credits on your 2016 personal federal income tax return that you filed in February.

0 kommentar(er)

0 kommentar(er)